A calm path through a difficult time.

When you don't know where to start, get instant clarity. Our interactive guide asks simple questions to build a personalized checklist for your exact situation.

Our Compassionate Mission

In times of stress and grief, individuals most need clarity and compassion. At KindFlare, our mission is to guide loved ones through the complexities that arise after someone passes away. We aim to illuminate a path forward, alleviating confusion, frustration and uncertainty for caregivers and grieving families during what is often an emotionally draining period.

Our Story

“The idea for KindFlare stemmed from our experience with my 90-year-old father’s passing last year,”... Read our full story here →

From Order to Action: Why Guidance Matters

Our tools bring clarity when it's needed most.

0%

of Canadian adults do not have a last will and testament.

$0+

in potential extra fees and lost assets for an unplanned estate.

0%

less stress reported by users with a clear, step-by-step plan to follow.

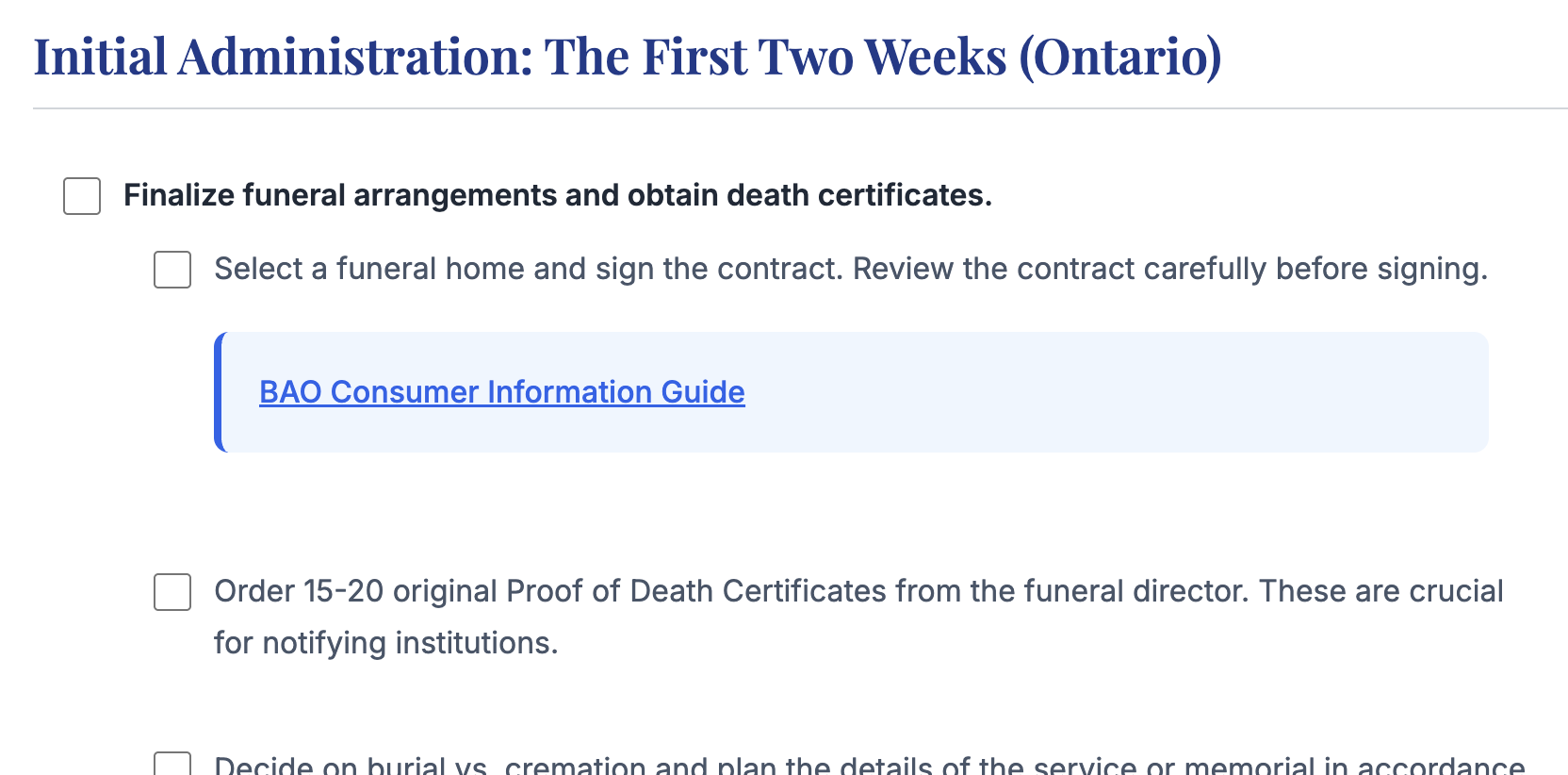

For an Immediate Need: Step-by-Step Guidance Through a Loss

Our condolences on your loss. Please know that support is available; you can find more information on navigating grief here. When you don't know where to start, our interactive guide asks simple questions to build a personalized checklist for your exact situation, cutting through the confusion and saving you hours of stressful research.

- Get a personalized, step-by-step checklist.

- Find the exact Canadian and provincial government forms.

- Craft clear emails to inform businesses and contacts.

- Save countless hours of searching and stress.

Your First 5 Steps

No matter what, these are the immediate priorities to focus on after a loss.

Obtain Legal Pronouncement of Death

This is the first official step. If in a care facility, the staff will handle this. If at home, call 911.

Notify Close Family & Friends

Reach out to immediate family and close friends for support. Don't be afraid to ask for help making calls.

Arrange for a Funeral Home

A licensed funeral director will guide you through all arrangements and the official death registration.

Locate the Will

The Will names the Executor and outlines wishes. Check personal papers, a safety deposit box, or with their lawyer.

Secure Property

Ensure the deceased's home, vehicle, pets, and important belongings are safe and secure.

The Hidden Costs of Not Planning Ahead

A lack of planning creates stressful and expensive problems for your family.

0%

of digital accounts are lost forever if not included in a plan.

0/10

executors report major family conflict due to unclear wishes.

$0+

in extra legal and admin fees for a disorganized estate.

Go Deeper: Create a Clear Roadmap for Your Family

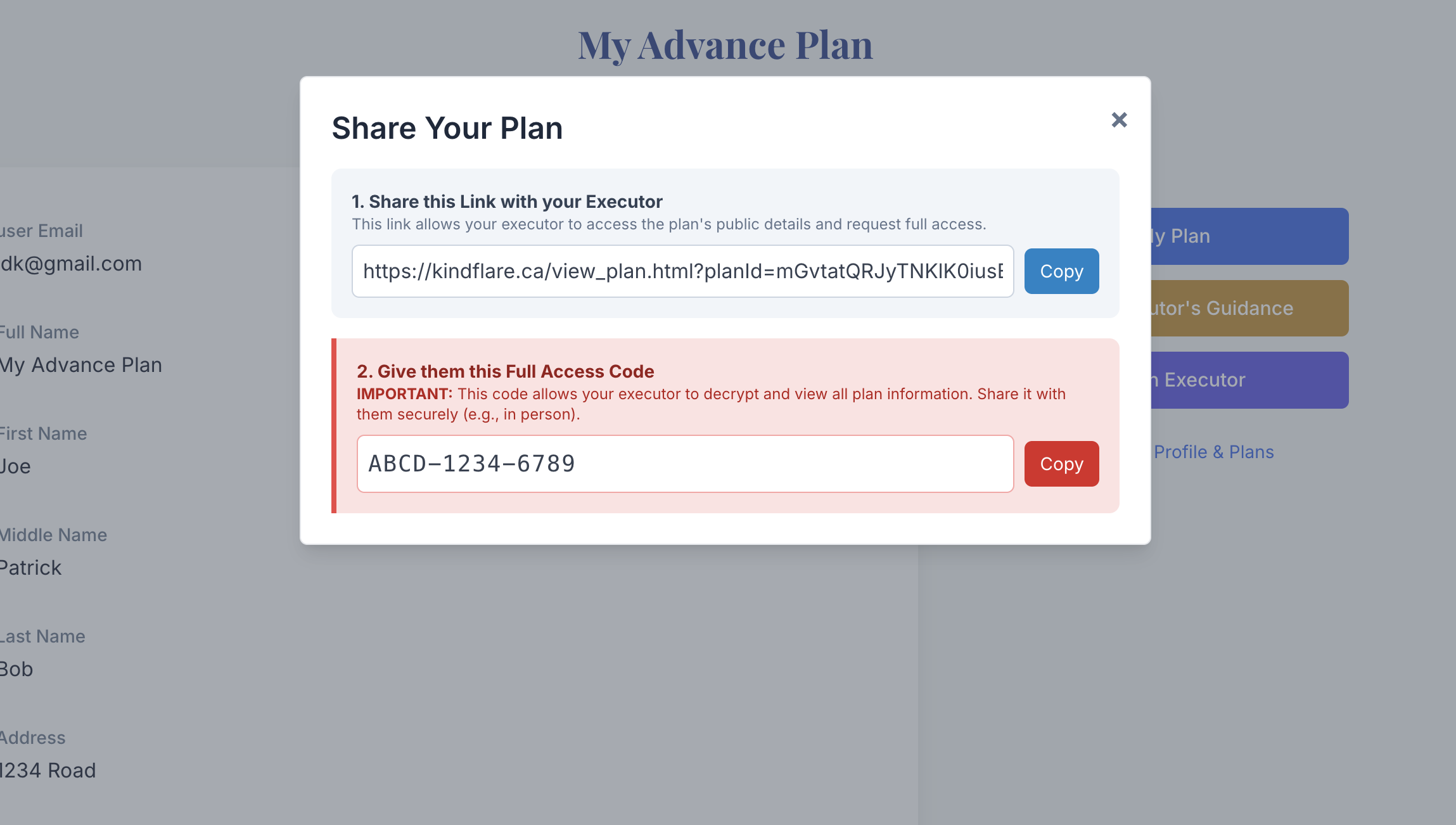

Prevent the stressful "scavenger hunt." Our Advance Plan tool helps you create a central, secure list of where everything is—from insurance policies to online accounts—so your family has a clear path to follow.

- Centralize your critical document locations.

- Store important notes and contacts securely.

- Share access safely with your executor.

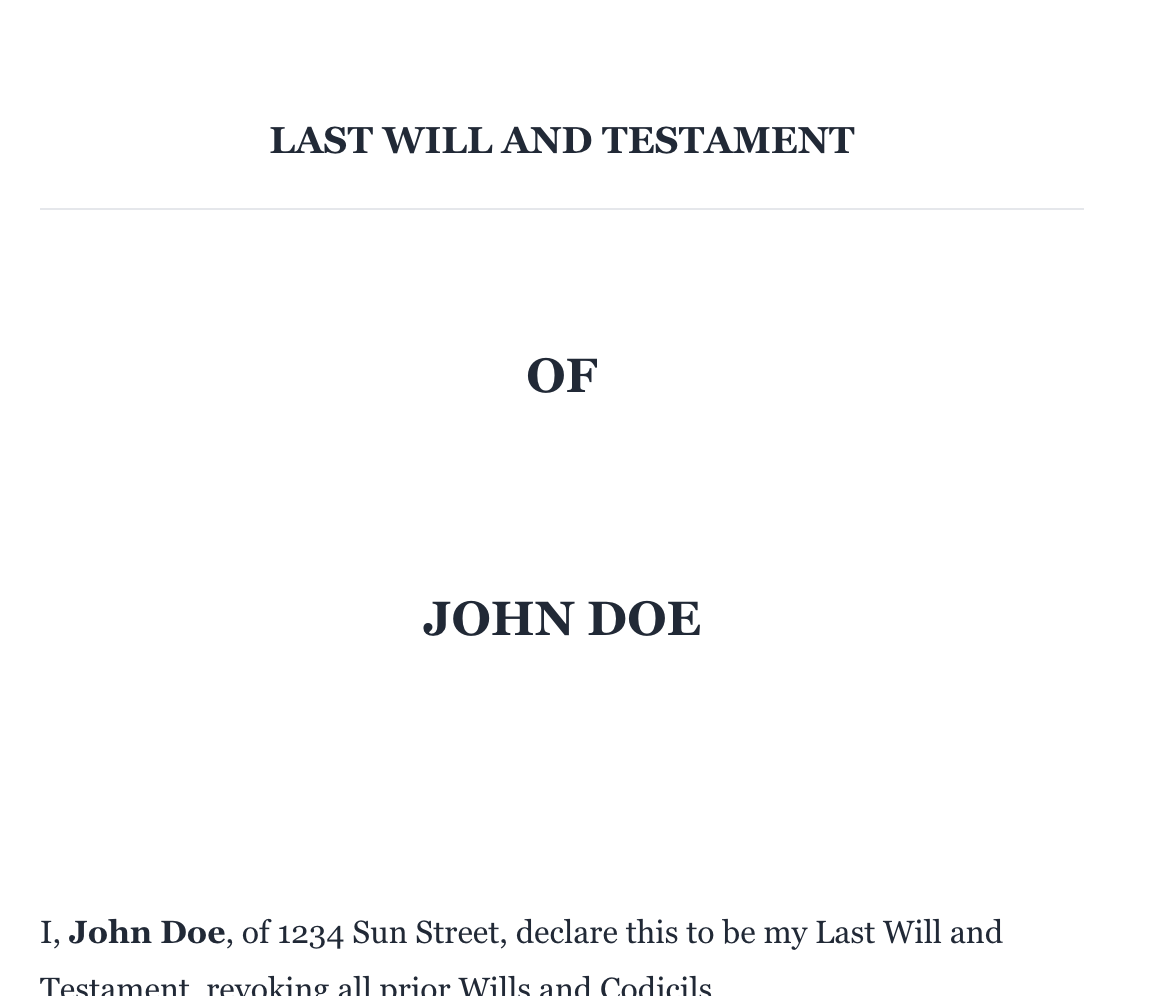

Take a Powerful First Step: Prepare Your Will for Free

Organize your wishes and assets with our guided questionnaire. You'll create a comprehensive preparation document to take to a lawyer, saving you significant time and legal fees.

- Organize your wishes and assets simply.

- Guided questions make it easy.

- Save significantly on legal fees.

Please Note: This tool does not create a legally-binding document.

Our goal is simple: to help gently guide you and your loved ones through a challenging time, offering essential to-dos, helpful checklists, and vital resources to ease the burden during grief.

Security You Can Trust

In a time of vulnerability, protecting your privacy is our highest priority.

✓Built on Google's Infrastructure

KindFlare is powered by Google Cloud and Firebase, meaning your data is protected by a world-class security architecture trusted by millions of businesses.

✓Bank-Level Encryption

All of your information is encrypted both in transit and at rest. No one can see it but you, not even the team at KindFlare. The only data our team can access is your name and email address for account purposes.

✓You Are Not The Product

We have a simple business model: our optional premium service. We will never sell, rent, or share your personal data with third-party marketers. Ever.

✓The "Roadmap" Principle

We are designed so you never have to enter sensitive data like bank account numbers or passwords. You simply note the location of items, creating a secure map for your executor, not a vault of data.

Your Questions, Answered

It's normal to have questions. Here are some in-depth answers to provide clarity.

How much does an average funeral cost in Canada?

Please note: These are national averages for services from funeral providers and are NOT fees from KindFlare. Our platform's premium service is a separate, one-time fee. Funeral costs vary widely by location and choices, but here is a general breakdown:

- Professional Services & Fees: $2,000 - $4,000

- Casket or Urn: $900 - $6,000+

- Ceremony & Venue Fees: $500 - $2,500

- Cemetery Plot / Niche: $1,500 - $10,000+

The total average cost can range from **$5,000 to over $15,000**. Using our Advance Plan to document your wishes is the best way to control these costs for your family.

What is an executor's first responsibility?

The very first responsibility of an executor is to find the deceased's original signed Will. This document is the source of their authority. Immediately after, they should arrange the funeral according to the wishes expressed in the Will or known by the family. Securing the deceased's assets—like their home and vehicle—is also a top, immediate priority to prevent loss or damage.

What happens to debt when someone dies in Canada?

When a person dies, their debts do not disappear. The debt is owed by their estate. The executor's job is to use the money and assets in the estate to pay off all outstanding debts (like credit cards, mortgages, loans) and taxes *before* any money or assets can be distributed to beneficiaries named in the Will. If there isn't enough money in the estate to cover the debts, family members are generally not responsible for paying them from their own funds, unless they were a co-signer on the loan or credit card.

What is Probate and Is It Always Required in Canada?

Probate is the formal court process that officially validates a Will and confirms the authority of the Executor. Banks and land title offices often require this court-certified document before they will release the deceased's assets. While not every estate needs probate (assets held jointly may pass directly to the survivor), it is commonly required for significant assets held solely in the deceased's name.

Do I Need a Lawyer for a Legally Binding Will in Canada?

While our Will Generator is an excellent first step to organize your intentions, it does not create a legally-binding Will. To create an enforceable legal document in Canada, there are strict formal requirements (like being signed in the presence of two valid witnesses who are not beneficiaries). Hiring a lawyer is highly recommended to prevent costly mistakes, especially for anyone with complex assets, business ownership, or a blended family.

What government benefits are available after a death?

The Government of Canada offers several benefits. The main ones include the CPP Death Benefit, a one-time payment to the estate, and the CPP Survivor's Pension, a monthly payment for the surviving spouse or common-law partner. There may also be provincial benefits available. Our guidance tool helps you identify exactly which ones apply to your situation.

How long does it take to settle an estate in Canada?

The timeline can vary significantly. A simple, well-organized estate might be settled in 6 to 12 months. However, if probate is required, assets are complex, or there are disputes among beneficiaries, it can easily take over a year, sometimes several years. The key to a faster process is clear documentation and organization, which is the core focus of our Advance Plan.

Can I decline the role of executor?

Yes, you can. Being named an executor in a Will does not obligate you to accept the role. You can formally renounce the position by signing a specific legal form. If you do this, the alternate executor named in the Will typically steps in. If no alternate is named, the court may appoint one. It's an important decision, as the role carries significant responsibility and liability.

Get Started Today

Choose the path that's right for you. No subscriptions, no hidden fees. Just help.

Start Planning

Organize your affairs to prevent stress for your family.

- ✓Advance Plan with Document Locator.

- ✓Will Generator to prepare for a lawyer.

- ✓Email Templates for final messages.

Premium Plan

For those navigating a loss right now. Get immediate, clear direction.

- All Standard features, plus:

- Generate Detailed Executor's Guidance

- Store multiple Advance Plans & Surveys.

- Securely share plans with designated individuals.